SafeBanking: Know the Signs. Stop the Fraud.

Romance scams often begin with steady messages and emotional connection before shifting to financial requests. When someone you’ve only met online asks for money, gift cards, crypto, or wire transfers, it’s a major red flag. Slowing down, talking to someone you trust, and contacting your bank if funds were sent can help protect both your heart and your wallet.

A new year is the perfect time to reset your passwords and strengthen login security. Updating weak or reused passwords and turning on extra protections like two-factor authentication can help stop unauthorized access before it starts and keep your accounts safer all year long.

A new year is a great time to review your accounts and tighten security. Check transactions, alerts, passwords, and beneficiaries to catch issues early. Small updates now can help protect your money and give you peace of mind all year long.

Scammers are posing as the U.S. Marshals Office, claiming your identity is tied to a federal investigation. They use authority and urgency to pressure victims into withdrawing cash and holding it “for protection,” sometimes even offering to come to your home. Real law enforcement will never ask you to move or safeguard money — hang up and verify directly with local police or your bank.

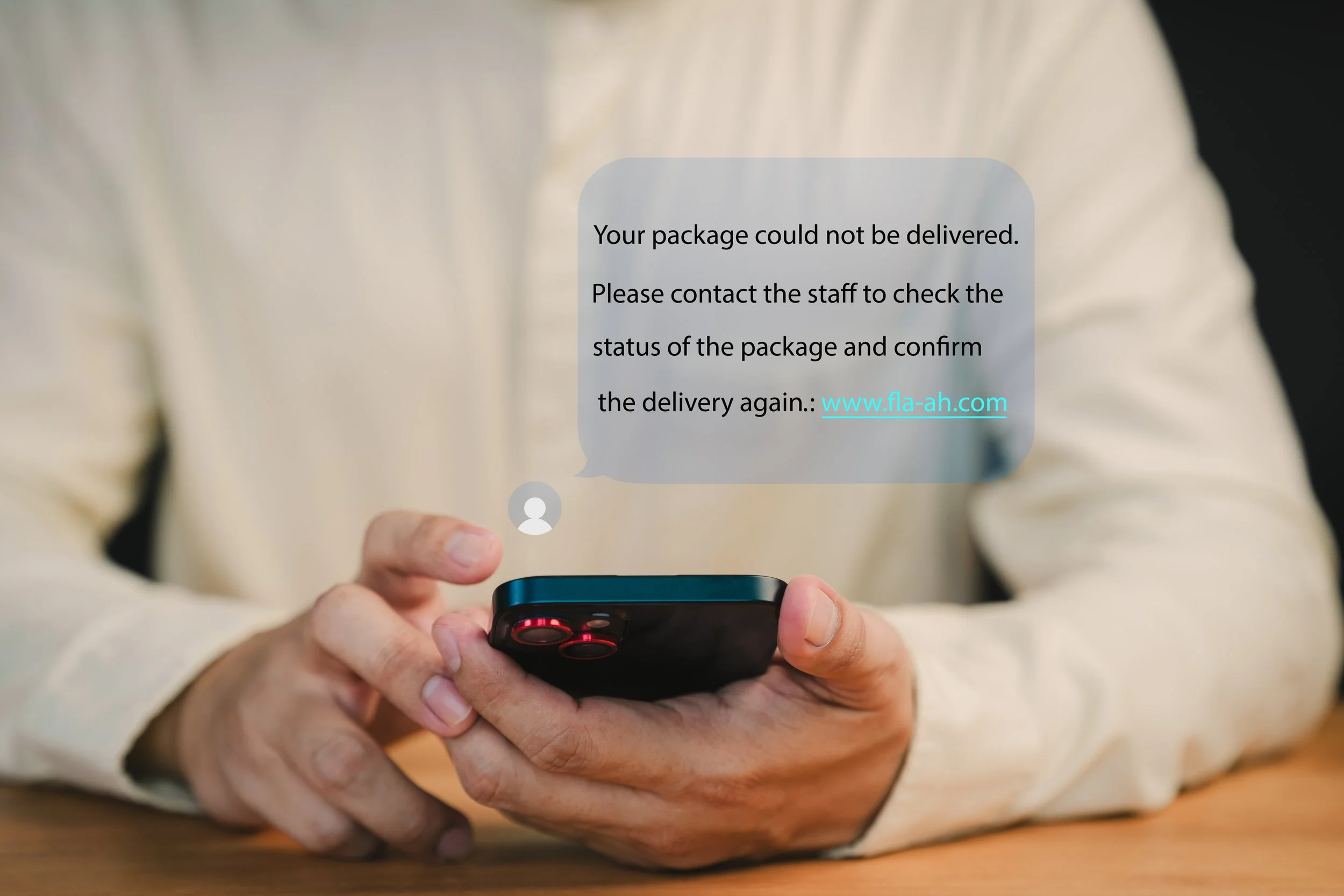

Scammers are sending fake holiday delivery alerts that look like USPS, UPS, FedEx, or Amazon. They claim there’s a problem with your package to pressure you into clicking a bad link or sharing personal info. Don’t trust unexpected messages — always check tracking directly through the official website or retailer.

Fraudsters are ramping up holiday scams with fake calls, emails, and texts that look real. They use urgent messages about purchases or deliveries to pressure you into sharing information or sending money. Don’t trust unexpected alerts — real companies won’t ask for sensitive details this way. Always verify through the official website or a direct phone call.

Scammers are sending fake emails and texts with dangerous links that look real. They try to scare you into clicking by claiming there’s an issue with your account or a delivery. Don’t trust unexpected links — real companies won’t ask for sensitive info this way. Always go to the official website or call the company directly.

Scammers are calling and pretending to be your bank, asking for “donations” to support a program or cause. Don’t fall for it — real banks never call customers to request money or personal information. Hang up and call your bank directly using the number on the back of your card.

Thieves are stealing checks from mailboxes, altering them, and cashing them for themselves. Don’t fall for it — this is check fraud and mail theft, both serious crimes. To protect yourself, use online bill pay or drop mail directly at the post office, and regularly monitor your accounts for suspicious activity.

Scammers send fake texts or emails claiming your tax refund, credit, or stimulus payment is ready and urging you to click a link to “confirm details.” Don’t fall for it — it’s a phishing scam. The Ohio Department of Taxation will never contact you by text, and the IRS will never initiate contact by text, email, or social media.

Scammers send fake texts claiming you owe for a ticket, with links to “pay now” and threats of license suspension or legal action. Don’t click — it’s a phishing scam. The BMV/DMV will never demand payment by text.

Bitcoin and wire transfer scams pressure victims into sending money through untraceable methods. Posing as officials, tech support, or sellers, scammers use threats or false promises to demand crypto or wires—something no legitimate organization will ever do.

Phishing, smishing, and vishing scams use fake emails, texts, and calls to steal personal and financial information. By creating urgency or offering tempting rewards, scammers pressure quick action and disguise themselves as legitimate sources—ultimately to commit fraud.

Romance scams trick people into emotional and financial manipulation, often using fake online identities to build trust and extract money. These scammers exploit dating apps, social media, and even professional platforms to create false relationships — and ultimately steal.

Card Controls enable you to manage all debit cards linked to your RiverHills Bank accounts, instantly freeze any card anytime, and allow you to set up card and alert preferences.